A rather bullish looking euro is looking at trying to get into 1.0800

The 1.0800 is quite a strong level technically. It's been an S&R level going back to early 2015. So, it's no surprise to see it acting up when we're testing it today.

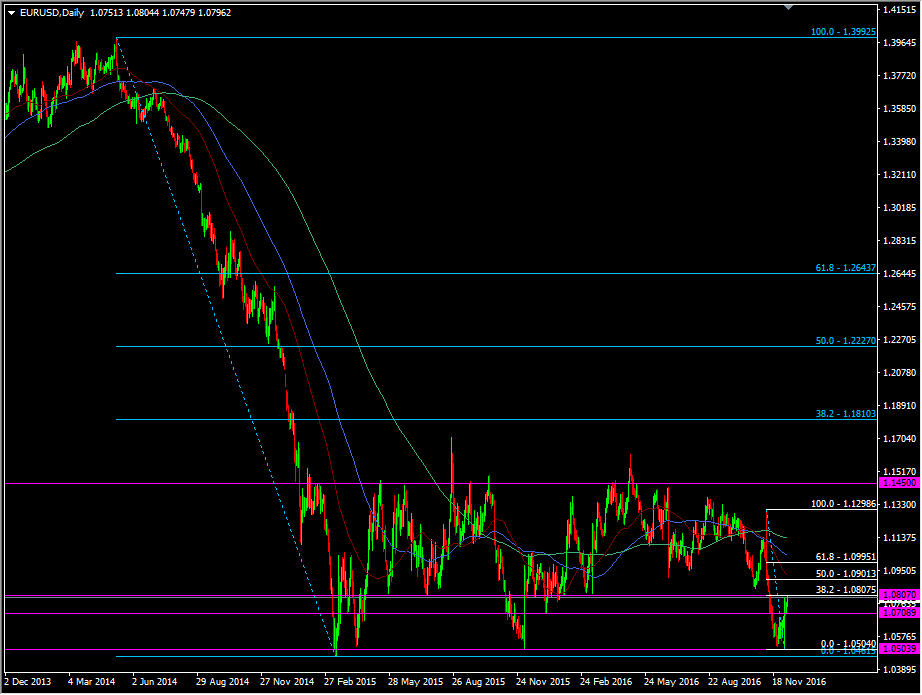

EURUSD daily chart

1.0807 is also the 38.2 fib of the Nov 9th drop from close to 1.13.

Probably at any other time this would be a good level to try a short but with the ECB a few hours away and plenty of shorts that are or maybe thinking about some covering, it's not a time to be a hero.

It's also being noted that there are stops somewhere above 1.08 (given it looks like we haven't hit any yet, they may be around 1.0810), and more through 1.0820, so a quick flush of those could see us up at the next resistance around 1.0845/50 pretty quickly.

Support is showing at 1.0780 and it's stronger looking at 1.0770. Again, I'd take it easy on trading those too as we're could see plenty of positioning ahead of the ECB.